Tax Land

-

A Reality Check on Wildlife Corridors

Vermont’s 2016 Act 171 requires towns to map and protect “forest blocks” and “habitat connectors,” but the policy has sparked growing frustration among landowners. Many…

-

Did You Vote for Collective Aesthetic Regulations?

Vermont’s Act 250 doesn’t just regulate pollution—it polices beauty. Under Criterion 8, projects can be denied for being “out of harmony” with the landscape. These…

-

A $1’s Journey: Where Your Taxes Go

Ever wondered where your tax dollars go? In Vermont, every dollar you pay supports education, healthcare, infrastructure, and more. Dive into a clear breakdown of…

-

Those Nickels & Dimes Add Up

The high cost of living in Vermont stems from rising business expenses, shrinking paychecks, and reliance on imported goods. Businesses pass on higher costs to…

-

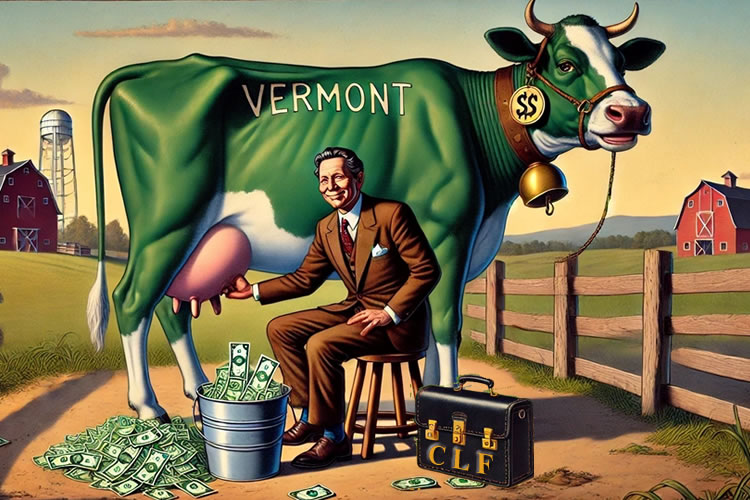

When Vermont’s Budget Outruns Its Economy

Vermont’s state spending has grown far faster than its economy over the past 20 years, creating a heavy reliance on federal aid and increasing taxes.…

-

Why There Isn’t Affordable Housing in Vermont

Vermont’s affordable housing crisis isn’t just about money — it’s about rules. From Act 250 delays to outdated fire codes, the state has built a…

-

Breaking a Bad Habit: Montpelier’s Regulatory Addiction

From Act 250’s debut in 1970 to Act 181 of 2024, Vermont’s land-use laws have expanded from local oversight to a unified system of ecological…

-

Strike-Alls: How a Bill Metastasized Into Your Backyard

In 2016, a short bill labeled “An act relating to timber harvesting” quietly rewrote Vermont’s land-use laws. A single sentence requiring towns to map “forest…

-

Montpelier Should Measure Twice, Legislate Once

Vermont keeps breaking ground on sweeping laws—the Clean Water Act, Three-Acre Rule, Global Warming Solutions Act, and Clean Heat Standard—before anyone knows how they’ll work…

-

Inside Vermont’s Eco-Litigation Loop: The Lawyers Who Write, Lobby, and Sue

Vermont’s environmental policy loop has turned circular: the same advocacy lawyers who help write state rules are now suing farms and agencies for not enforcing…

Signup Newsletter

By signing up, you agree to the our terms and our Privacy Policy agreement.

Make a Difference!

Contact FYIVT

Latest Posts

Latest Comments

Archives

- March 2026 (5)

- February 2026 (60)

- January 2026 (51)

- December 2025 (31)

- November 2025 (30)

- October 2025 (32)

- September 2025 (30)

- August 2025 (31)

- July 2025 (31)

- June 2025 (35)

- May 2025 (33)

- April 2025 (35)

- March 2025 (38)

- February 2025 (33)

- January 2025 (33)

- December 2024 (51)

- November 2024 (109)

- October 2024 (76)

- September 2024 (22)