America’s national debt has become the stuff of staggering numbers, the kind that almost stop making sense. Federal debt now sits above $37 trillion, more than 133% of GDP, and rising. On a per capita basis, every man, woman, and child carries roughly $109,000 of federal debt on their back. Imagine someone handing you a six-figure mortgage bill just for being alive — that’s where we stand.

To grasp the scale, think of it this way: if you earned a dollar every second, twenty-four hours a day, it would take you 31,688 years to amass a single trillion dollars. Elon Musk’s notional trillion-dollar net worth could, in theory, wipe out the debt burden for 10 million Americans. But that would only cover about a year’s worth of new debt at current spending levels — a drop in the bucket against the $37 trillion tide.

The Old Red Line: 100% Debt-to-GDP

For decades, a debt-to-GDP ratio of 100% was considered the threshold of unsustainability. When total debt equals a nation’s annual output, the thinking went, it signaled an economy in a danger zone. The U.S. crossed that line around 2020, and today, by some measures, we’re closer to 133%.

We’ve been here before, briefly: during World War II, debt soared past 100% of GDP. But the difference then was context — the war ended, America ran budget surpluses, and the postwar boom drove growth that shrank the ratio back under 40% within a generation.

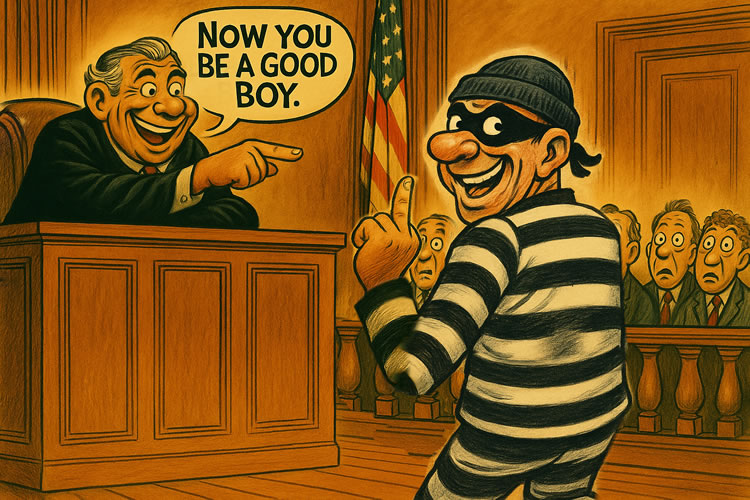

This time, there’s no war victory to mark an endpoint, and no realistic path to growth or surpluses big enough to reverse the tide. Instead, debt is piling up to fund permanent entitlements, interest payments, and a political culture addicted to deficit spending.

The Interest Doom Loop

The real problem isn’t just the size of the debt, but the cost of carrying it. Interest rates, once near zero, are now closer to 4–5%. That means every time the Treasury rolls over debt, the bill gets bigger. Net interest costs already exceed defense spending, and by 2027 they are projected to exceed all non-defense discretionary spending — everything from highways to scientific research to education.

This is the doom loop: debt grows, interest payments consume more of the budget, leaving less room for anything else. To fill the gap, Washington borrows more, which drives up debt, which drives up interest… and the spiral accelerates.

The Congressional Budget Office (CBO) projects debt held by the public will hit 150% of GDP by the early 2050s — and that’s under rosy assumptions of no wars, no recessions, no major shocks. Real life is rarely so forgiving.

The Illusion of Safety

Modern Monetary Theory (MMT) enthusiasts argue this is all fine. Because the U.S. issues its own currency, it can never “run out” of dollars. Deficits don’t matter, they say; the only limit is inflation. Taxes aren’t to fund spending but to manage demand.

But MMT is built less on math than on faith — faith that investors will always buy Treasuries, faith that Congress can fine-tune taxes to control inflation, faith that the dollar will never lose its reserve currency status. History teaches otherwise. Inflation is political dynamite, markets are not infinitely patient, and confidence is fragile. Printing money may delay the reckoning, but it can’t erase compounding interest.

🍁 Make a One-Time Contribution — Stand Up for Accountability in Vermont 🍁

The BRICS Sword of Damocles

Foreign creditors add another layer of risk. Roughly $7.6 trillion of U.S. Treasuries are held abroad, with China and Japan each holding close to $1 trillion. If China and the broader BRICS bloc decided to stop buying Treasuries — or worse, dump them — the immediate result would be a spike in bond yields, a weaker dollar, and financial shockwaves through every bank and pension fund tied to U.S. debt.

Would Beijing really cut its own throat that way? Probably not — they rely on exports to American consumers, and their own reserves are tied up in Treasuries. But authoritarian regimes can tolerate pain in ways democracies cannot. If the strategic prize is weakening the U.S., they can spin the suffering as patriotic sacrifice. That gives them leverage.

The more likely path is slow erosion: BRICS nations gradually de-dollarizing, using gold or local currencies for trade, reducing their need to hold Treasuries. That steady drift is just as dangerous, because it chips away at the structural demand that has let the U.S. finance deficits cheaply for decades.

Where This Leaves the Citizen

This is where the numbers stop being abstract and start touching daily life. If interest costs crowd out federal spending, it means fewer dollars for infrastructure, healthcare, and education. If inflation becomes the tool to manage debt, it means higher grocery bills, eroded savings, and unstable prices.

What can individuals and families do? The federal balance sheet may be out of our control, but our personal ones are not. Practical resilience steps matter:

- Pay down high-interest debt, especially variable-rate loans.

- Build emergency savings and diversify assets into a mix of cash, real property, and inflation hedges.

- Invest in skills and income streams that can weather volatility.

- Maintain modest stockpiles of essentials and strengthen local community ties.

In short: run your household the way you wish the government would — low leverage, diversified, and with buffers for shocks.

A Thin Thread of Hope

If there is hope, it lies in two truths. First, America has faced dire numbers before — in the Civil War, the Depression, World War II — and recovered through a mix of innovation, growth, and painful reform. Second, on the personal level, resilience isn’t just possible, it’s achievable. Families that build strong financial foundations, real assets, and supportive networks will be far better positioned to withstand turbulence than those who assume Washington will solve it.

The numbers are monstrous. The trajectory is unsustainable. But collapse is not destiny — it is a path, and paths can be changed. Whether by policy, reform, or personal preparation, there is always a margin of hope, however narrow.

Dave Soulia | FYIVT

You can find FYIVT on YouTube | X(Twitter) | Facebook | Instagram

#fyivt #FoodHistory #CanolaOil #SPAM

Support Us for as Little as $5 – Get In The Fight!!

Make a Big Impact with $25/month—Become a Premium Supporter!

Join the Top Tier of Supporters with $50/month—Become a SUPER Supporter!

Leave a Reply